In the vast world of manufacturing and industrial tools, grinding wheels stand out as indispensable companions, providing the precision and efficiency required for shaping, cutting, and finishing various materials. Despite their ubiquity, these essential tools are subject to international trade regulations, classified under the Harmonized System (HS) code. Let’s delve into the intricacies of the HS code for grinding wheels and understand its implications for global trade.

Grinding Wheels: The Backbone of Precision Machining

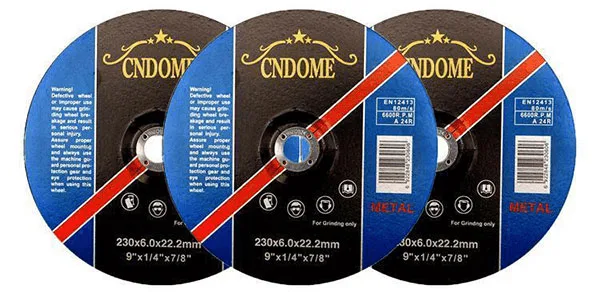

Grinding wheels, the unsung heroes of machining, are composite tools composed of abrasive particles bonded together. These wheels come in diverse shapes, sizes, and compositions, tailored to meet the specific demands of different materials and machining tasks. Whether it’s smoothing metal surfaces, refining woodworking projects, or polishing intricate details, grinding wheels play a pivotal role in achieving desired outcomes with finesse and accuracy.

Navigating the Harmonized System (HS) Code

The Harmonized System (HS) is a globally recognized classification system used to standardize the categorization of traded goods. Developed and maintained by the World Customs Organization (WCO), the HS code assigns a unique numerical code to each product, facilitating streamlined customs procedures, tariff calculations, and trade data analysis.

Cracking the Code: Grinding Wheels in the HS Classification

Grinding wheels find their place within the Harmonized System under Chapter 68, which encompasses “Articles of Stone, Plaster, Cement, Asbestos, Mica, or Similar Materials.” More specifically, grinding wheels are categorized under subheading 6804.22. However, the classification nuances may vary depending on factors such as abrasive material composition, wheel dimensions, and intended applications.

Factors Influencing Classification

Understanding the HS code for grinding wheels entails consideration of various factors that influence their classification. For instance, the abrasive material used—whether natural (e.g., corundum, diamond) or synthetic (e.g., silicon carbide, aluminum oxide)—may warrant different sub-classifications. Additionally, distinctions based on wheel dimensions, shape, and intended use further refine the HS coding process.

Trade Compliance and Implications

Accurate classification of grinding wheels under the HS code is imperative for international trade compliance. Importers and exporters must meticulously determine the appropriate HS code for their grinding wheel products to adhere to customs regulations and tariff structures. Failure to do so may result in delays, penalties, or other trade-related complications.

Conclusion: Unveiling the Significance of HS Codes for Grinding Wheels

Grinding wheels, despite their seemingly straightforward nature, are subject to intricate classification systems governing international trade. The HS code provides a standardized framework for categorizing these essential tools, ensuring regulatory compliance and facilitating seamless cross-border transactions. By deciphering the HS code for grinding wheels, manufacturers, traders, and policymakers alike can navigate the complexities of global trade with precision and confidence, ensuring the uninterrupted flow of these indispensable tools across borders.

Online Message

Minimum Order Quantity: 5,000 Pcs, 10 Pcs Free Samples.

Contact Us For More Information!

Tel/WhatsApp

+86 18796960868

[email protected]

Address

mNOQsCkhIwLMBc